Opus 21: Investing Adventures in Lithuania

Finding opportunities in one of the best performing European stock markets

Why Lithuania?

Due to the positive reception of the Investing Adventures in Bhutan posts (Part 1 and Part 2), it felt appropriate to continue the series. There are many more exciting stock markets to explore - Nepal, Turkmenistan, and Kyrgyzstan are all top of mind - but I’ve decided to head to the Baltics instead.

My wife is Lithuanian and over the last five years we have spent considerable time in the country. Prior to our relationship, I knew very little about the Baltic region as a whole. The American education system does not focus on these countries and their history. Today, the Baltics play a more critical role than ever. Geopolitically, they are the leading voice in Russian opposition; these countries have spent decades convincing Western European nations not to rely on Russian trade. Lithuania also ranks near the top of all NATO member nations when it comes to defense spending and funding commitments for NATO as a percent of GDP.

It only feels right to opine on a country after spending time there. It was a mere nine days in Bhutan, but this experience provided an on-the-ground perspective that was key in beginning to understand the country. I have spent far more time in Lithuania and thus feel more qualified to write about it.

Here is a quick overview of Lithuania to start:

Population - 2.8M (down from the 3.7M peak in 1990), about the same as Kansas and Armenia

GDP - $70B, similar to Croatia, Costa Rica, and the state of Rhode Island

Size - 63,000 km, roughly the same size as Sri Lanka and West Virginia

GDP per capita PPP - $49,250, between Spain and the Czech Republic

Inflation - 3.1%, down from 20% in 2022, which was the highest in Europe

Biggest exports - Refined petroleum1 (7.8%), furniture (5%), wheat (3%), and scientific laboratory reagents (2.8%)

Median age - 44 years, 15th oldest average age country in the world

GDP Growth - fastest growing European economy since 2000:

Lithuania’s Credit Situation

One of Lithuania’s current challenges is its banking and credit sector. To put it bluntly, the credit system is not working as it should be, especially considering the country’s wealth levels.

Lithuania’s consumer / household debt as a percent of GDP stands at 24%, which is comparable to countries such as Bulgaria and Russia, countries with <50% of the relative GDP per capita on a nominal basis and 75% on a PPP basis and far less access to the European capital markets. Non-financial corporate debt is 16% of GDP, again, similar to Kazakhstan, Romania, and Pakistan, all of which are far poorer countries from an income and household wealth standpoint. Compared to its economic peer group (Spain, Czech Republic, Slovenia, and Portugal), the country has low unemployment, a diversified economy, and comparable government spending but far less credit penetration.

The Lithuanian banking sector is mainly controlled by two foreign banking institutions - SEB and Swedbank, both Swedish - that entered the country in the 90s and hold 50+% of all deposits together. Lithuanians hold 85+% of their deposits in just four banks. It is one of the most concentrated banking sectors in the developed world, with the remaining banks holding almost no deposits. Compare this to the American situation where we have the most diversified banking sector in the world and 4,200 chartered banks.

Capital adequacy ratios - the amount of buffer banks have within their balance sheets - are incredibly high across the Baltics, with Latvia and Estonia ranking the highest in Europe. Lithuanian banks are not taking the requisite risk for credit expansion to happen across the economy, with most banks reporting CET1 ratios of 18-20+%. Oddly, Lithuanian and Estonian banks have the smallest amounts of Tier 2 capital, as can be seen in the difference between the Tier 1 and total capital ratios below2:

Admittedly, it is still unclear to me why this is the case. Like the rest of the world, many Lithuanian banks were wiped out in the GFC, and there may be extended shock from those events that have forced bank managers and regulators to take an overly conservative stance. Lithuanian banks also have some of the largest net interest margins (the spread between deposit and loan rates), which are wider than most other banks around the world. Due to the lack of competition, banks have not needed to close this gap.

Efficient markets would suggest that highly profitable banks with abnormally high capital ratios would inevitably cause more market competition from domestic upstarts and other foreign financial institutions entering the market.

Recent news suggests that the government sees the same issue and is trying to get other banks to enter the country. Several regional banks are also working to raise regulatory capital to enter the country, per the discussions I had with local experts. However, this capital requirement is quite high ($15M), which deters many entrepreneurs from setting up a new bank.

While the following charts are for Latvia, the data is still illustrative of the region’s credit conundrum:

Maybe it is not an availability of lending supply issue but rather a borrowing demand problem when it comes to a lack of consumer credit utilization. While this is an unfair oversimplification of an entire population, the Lithuanian people, especially those born before the country’s independence, are weary of credit. Very few people within the older generations hold credit cards or auto loans, and many purchase their homes entirely in cash. While it is not statistically significant, I see this same behavior in my Lithuanian family, with few people holding credit cards or loans on any of their vehicles, homes, or other assets.

Interestingly, Lithuania ranks 12th in the entire world when it comes to homeownership rates, with 89% of the population owning their home. Renting is now just starting to become popular due to housing affordability issues. Over 80% of new home purchases in Lithuania are now made with a mortgage, but much of the housing supply has not changed ownership due to much of the older population living in the same home for many decades.

Money Laundering & Banking Fraud

Lithuania’s banking issues could be, at least in part, due to the country’s banking history. Even though the country achieved sovereign independence in 1991, Russian people and influences still remained entrenched throughout the country’s banking sector.

Unfortunately, the Baltics have been a corridor for Russian, Belarusian, and Ukrainian fraud over the last two decades. Since the region entered into the European Union in the early 2000s, its financial systems have been opened up freely to the Western credit and money transmission systems, allowing for fraudulent account openings, transfers, and loans to be made. The highest profile case involved Snoras Bank, Lithuania’s 5th largest bank at one time, which was taken over by the government in 2011. The entire story by the OCCRP - full of assassination attempts, extradition, F1 race cars, etc. - is a worthwhile read. In 2013, Lithuania’s now defunct Ukio Bank was caught in the massive $4.6B Russian Troika fraud. These crimes were not unique to the smaller, lesser-known banks in Lithuania. Swedbank, the largest bank in Lithuania, was exposed in both the former Ukrainian president’s bribe scandal along with Iskandar Makhmudov’s money laundrying crimes from 2011 to 2015. New financial technology firms also took advantage of Lithuania’s banking system, with Railsbank, once a fintech darling of the VC world, using their Lithuanian entity for large-scale money laundering.

Lithuania was also a hotbed for crypto companies in the 2020-2021 area as the country was offering licenses for these companies that could then use Lithuania’s EU status to passport across the European Union and service all EU users. Over 1,000 licenses were issued. The scale of this market in Lithuania reached massive levels, with one company, Bifinity, the payments company for Binance, becoming the nation’s second-largest corporate taxpayer in 2022.

In reaction to the money laundering issues, the new Anti-Money Laundering and Countering Financing of Terrorism Center was set up in Vilnius. Hopefully, these latest enforcement efforts can help Lithuania reign in many of these problems.

Lithuania’s Technology Sector

Lithuania is an oasis for new technology company creation, innovation, and investment. Tesonet, the owner of Nord Security, recently raised $200M and is planning to publicly list in the near future. Kilo Health is the largest holding company of health, fitness, and wellness apps for people around the world. PV Case recently raised $100M to further the development of industrial-scale solar deployments. The country is home to dozens of scale-ups across consumer technology, B2B software, climate technology, and other innovation sectors.

The country boasts one of the highest technical coding literacy rates (% of the population that knows how to code) in the world due to it being one of the main destinations for high-end outsourcing of engineering costs over the last few decades. As Lithuania grew and people started to become more entrepreneurial, this local engineering talent supercharged their companies.

While Estonia historically has been the region’s technological capital with companies like Skype, Bolt, Wise, etc, Lithuania is now the fastest-growing technology hub in Europe. This is no longer a secret, with many capital groups now focusing on the country. Lithuanians are focusing on harder, more technical problem sets as well. Given Lithuania’s political and physical position in relation to Russia and Belarus, there are many new defense technology companies being created along with defense-focused investment funds.

Lithuanian Stock Market

As of December 2023, there are 25 publicly traded companies on Lithuania’s exchange. The Vilnius Stock Exchange (VSE) is a wholly owned exchange of the Nasdaq Nordic / Baltic company. The total market capitalization of the companies listed on the exchange is ~€4.5B or 6.8% of the country’s GDP. Altogether, the monthly liquidity of the securities amounts to $15-17M in recent months. On an annual basis, the exchange experiences ~5-6% turnover in relation to its total market capitalization. The U.S. Nasdaq sees ~300% annual market cap turnover.

Over the past decade, the Lithuanian domestic equity market index (OMXVGI) has outperformed its European peer group (Germany, France, Poland, Spain, etc.) by a wide margin. Since 2013, the index (black line below) has returned 126%, which is roughly in line with the S&P 500’s return in the same period. It is eye-opening to see the lost decade for many European markets that have returned next to nothing or, in the case of Poland and Spain, lost value over the ten-year period.

The OMXVGI index has only trailed its Latvian sibling (RIGSE) over a ten-year period:

While I cannot find official data on the component weighting of the index, it seems much of the performance over the last ten years has been driven by the following companies: Invalda, Grigeo, Siauliu Bank, Rokiskio Suris, and Zemaitijos Pienas. Oddly, many of the larger constituent companies (Ignitis, Telia, Amber Grid, etc.) have under-performed which makes me question the index’s construction, something I was not able to find information about - if anyone has official exchange-level data on index weighting, please send it my way.

The broader Lithuanian market trades at a very reasonable ~10x earnings. This is ⅓ of the S&P 500’s earnings multiple and a 15-25% relative discount to the other major European indices such as the CAC40, DAX, FTSE, etc. Much of this discount is likely attributed to the country’s perceived geopolitical risk, given it borders both Russia (Kaliningrad) and Belarus. The country has also had some of the highest inflation in all of Europe, along with two consecutive quarters of economic contraction. The decades of shrinking population have also hurt local consumption, but this trend has reversed in recent years with immigration increasing and Lithuanians returning home in large numbers.

Many Lithuanian public companies are mostly government-owned with a small public float - similar in some ways to the US’s Fannie Mae / Freddie Mac, at least from what I can gather reading through some of the shareholder documentation. These are remnants of the mass privatization efforts that happened once Lithuania achieved independence from the USSR. This creates unique shareholding effects, with very little of the share capital being available to active investors. Examples include Amber Grid, the country’s natural gas pipeline operator, which is 96% owned by Lithuania’s Energy Ministry. Lit Grid, Lithuania’s electrical grid operator, is also 97% owned by the Energy Ministry. Ignitis Group, a large energy production company, is the country’s largest public company by market value and is 75% owned by Lithuania’s Finance Ministry. The lack of public float discourages real trading activity and ownership, as investors have no way of enacting change through shareholder governance. The largest company, Ignitis Group, which has a market capitalization of $1.5B, rarely experiences daily trading volume exceeding $500K.

There are still a number of State Owned Enterprises (SOE) within Lithuania which include airport companies, railways, and other energy infrastructure. There are no current plans to privatize any of these assets.

Many of Lithuania’s largest companies are still private and founder-owned. These include Girteka (one of Europe’s largest trucking companies), Avia Solutions (aviation operations, maintenance, and insurance), Tesonet (owner of Nord Security and other internet assets), MG Group (retail and real estate), Maxima Group (largest grocery retailer and wealthiest Lithuanian’s company), SBA Group (furniture, textile, modular construction, and real estate), and many others. It is expected that many of these companies will list in the coming years, but it is unclear whether they will list on the local market or elsewhere in Europe. Many of these companies’ founders are the wealthiest Lithuanians.

Siauliu Bank(as) - $450M market cap, 535% 10Y return

The only domestic Lithuanian bank of any real size is Siauliu Bank. Founded in 1990, the bank operates in both consumer and commercial financial products. At the time of this writing, the bank’s current market capitalization is ~$450M. Siauliu Bank is one of the best-performing Lithuanian equities over the last decade, returning 554% since 2013, or a 20.6% CAGR. This is compared to the US bank index’s annual return of ~4.7% in the same 10-year period. Looking at its Baltic and Polish local banking counterparts, Siauliu Bank has outperformed all of them by a healthy margin:

As of Q3 ‘23, the bank had €1.4B in Corporate loans, €755M in mortgages, and €670M in other consumer loans. The bank holds €3B in deposits across ~200,000 accounts.

Siauliu Bank is a well-run bank. It has reported an average of 12.4% revenue growth per year since 2013, along with an average earnings growth of 33% in the same period. The bank has a 10-year average ROE of 16.6%, which is extremely high and comparable to US bank ROEs prior to the GFC; post-2009, the US banks rarely report ROEs >10% due to increased capital requirements and lower profitability. Siaulius Bank reports this ROE even while having elevated equity levels (20.3% CET1) far above the regulatory minimum of 10.7%. Siauliu Bank management pays 20-30% of earnings out in the form of dividends, resulting in a 2023 dividend yield of 8%, one of the highest for any equity in the Baltics.

The bank’s shareholding and overall capital structure is in a dynamic situation. As outlined in their Q3 report, the bank’s major shareholder is divesting a majority of their stake:

“The European Bank of Reconstruction and Development (EBRD) possessed 26.02% of the authorised capital and votes of the Bank. On 22 December 2021 EBRD announced that it has agreed to sell an 18 % stake in Bank. EBRD has signed 3 separate agreements with Invalda INVL, an asset management group, Tesonet Global, (part of the Tesonet group of companies), and Willgrow, a holding company that owns Girteka Logistics, to sell stakes of 5.87%, 5.87% and 6.29% in Bank”

Now onto valuation… this bank is cheap. As Enlight Research said, it is “ridiculously cheap” with a 2023E PE of 4.5x and a price to book of 0.66x. To give some context, this is a comparable PB to that of Associated Bank, a regional bank out of Green Bay, Wisconsin. Associated Bank, in comparison, has grown earnings over the last decade at a depressing rate of 8% (compared to Siauliu Bank’s 33%), has a 4.7% dividend yield, an ROE of ~8-9%, CET1 capital of 9.5%, and has only grown revenue at 3% a year for ten years. It is in a far worse financial position, but yet it commands the same valuation. It is also important to note that Associated Bank operates in one of the most competitive financial markets in the world with hundreds of competing firms.

Siauliu Bank recently closed its acquisition of Invalda’s retail investment and insurance businesses. Siauliu Bank will now be a full-service bank offering deposit accounts, credit solutions, investment products, and insurance to its client base.

Siauliu Bank appears to be a strong asset, operating in an oligopolist market with little other competition, and is priced as if it is about to fail. I believe the market has not appropriately rewarded the bank for its strength, profitability, and near-term opportunities on the horizon. It is rare to find a bank in a post-GFC world that has this level of capital efficiency while simultaneously possessing a fortress balance sheet.

Apranga Group - $160M market cap, 107% 10Y return

Moving to the retail sector, Apranga Group is a fashion retail company that operates 170 stores across the Baltics within youth, adult, luxury, and everyday fashion clothing. It is the sole franchise rights holder for the Inditex group (Zara) in the Baltic region. While listed on the Vilnius Exchange, the business is mostly owned by MG Group, a holding company of construction, retail, telecommunications, trading, and other businesses. MG Group recently paid a €1.1M settlement as part of the ongoing political bribery scandal regarding its management team. It is unclear why MG Group decided to list Apranga Group as all of its other businesses remain privately held. Apranga was set up to absorb the privatization of the Lithuanian State textile / clothing assets in the early 90’s. MG Group has plenty of other interesting history that is worth reading here.

The business does ~$275M in revenue across their business units and grew revenue ~4% / year over the last decade, roughly in line with GDP growth for the region, which makes sense for a cyclical, consumer discretionary business.

Apranga has not grown earnings (blue below) over the last decade but has seen a significant increase in both operating cash flow and free cash flow. This is mostly due to an increased depreciation as a result of the 4x in PP&E earlier in the ten year period.

The business paused dividend payments in 2020 and 2021. While revenue did decrease in 2020, the business had a record year for both FCF and operating cash flow. Net cash change in 2020 was $23.8M. I assume management wanted to bolster the balance sheet in 2020 as no one really knew what the future held for in-person retail amidst the pandemic lockdowns. Today, though, the business has resumed its dividend and is currently offering a 10% dividend yield.

Due to the company’s sensitivity to consumer discretionary spending, Apranga’s future financial position is hard to understand. It trades roughly in line with other retail businesses across Europe and is fairly valued today, although the 10% dividend yield, the highest of any Baltic retail business, would be a great income addition to a portfolio.

Vilkyskiu Pienine (Vilvi Group) - $60M market cap, 150% 3Y return

One of the best-performing stocks over the last three years is Vilkyskiu Pienine, which operates under the brand Vilvi Group. The company is a large dairy production business specializing in cheese, milk, cream, yogurt, and protein products. It is one of the largest dairy brands in the Baltics and exports around the world to dozens of markets. The company was founded in 1993 by Gintaras Bertašius who remains the CEO today.

The stock (black line below) has returned an impressive 150% over the last three years, drastically outperforming its peer group of food product companies across the Baltics and Central Europe:

Like many businesses around the world, Vilvi Group experienced strong growth coming out of COVID-19, but has shrunk from 2022 to 2023 as consumer demand normalizes. Revenue growth in 2021 and 2022 averaged an impressive 30% due to both unit and price growth as the Lithuanian economy rebounded.

For the first nine months of 2023, the business reported revenues of €153M, down from €175M in the same period the year prior. Operating cash flow jumped from €6.8M in the 2022 period to more than €16M in 2023. This was mostly attributed to a sell-down of net inventory, which allowed the business to efficiently recycle cash into the business. The business also paid down a significant portion of its debt, which I assume it raised in order to fund its acquisition of Latvian SIA Baltic Dairy.

The business has reached an all-time low valuation of 5.4x LTM earnings while simultaneously reaching record levels of operating cash flow, free cash flow, and capital efficiency. The 2023 sequential contraction in the top line should be temporary, and the business will return to revenue growth in 2024.

The one oddity regarding Vilvi Group is that it is majority-owned by a Swiss private equity group, SwissPartners, but the group is not active in managing the company or operations, even to the point that they have forfeited their voting rights on the latest board actions to the CEO of the business according to the company’s Q3 filing.

Baltics Classified Group (BCG) - $1.05B market cap, 22% 2Y return

While it does not trade on the OMX Vilnius exchange but rather the LSE, Baltic Classified Group still generates a majority of its revenue from the Baltic region and is headquartered in Vilnius. BCG operates dozens of marketplaces across auto, retail, employment, and real estate listing sites. It has been a Lithuanian success story and the only internet business to go public so far.

The business was established in 1999 and started two online classified portals in Lithuania. BCG was acquired in 2014 by Estonian MM Group and subsequently sold to Apax, an American private equity group, which eventually led the company to its 2021 IPO.

BCG is a high-quality asset and is priced as such. The business trades in the 80th - 95th percentile across almost all valuation multiples when compared to its peer group and most European internet companies. The stock trades at 28x forward earnings, an all-time high multiple for the business.

The rich valuation is deserved. The business is growing revenues by 20% with 75% EBITDA margins and 40% operating margins. BCG makes the traditional “rule of 40” look like child’s play. The business has reported $67M in LTM revenues and $32M in operating income.

The business does have lower ROE / ROA due to its large goodwill holding as a result of the dozens of acquisitions the business has made - 92% of the business’s assets ($363M) sit in goodwill. The business is amortizing ~4.5% of the goodwill value a year, providing a 16M tax shield over the last year. BCG has yet to make any impairment adjustments on the goodwill. Unadjusted LTM ROA is an unimpressive 4.3%, but when taking out the goodwill, this figure jumps to 18.5% - the magic of intangibles.

Telia Lithuania - $985M market cap, 210% 10Y return

The country’s leading telecommunication company is Telia LT, a subsidiary of the Swedish Telia AB. The Swedish parent owns 88% of the company and the remaining 12% is floated on the Vilnius exchange.

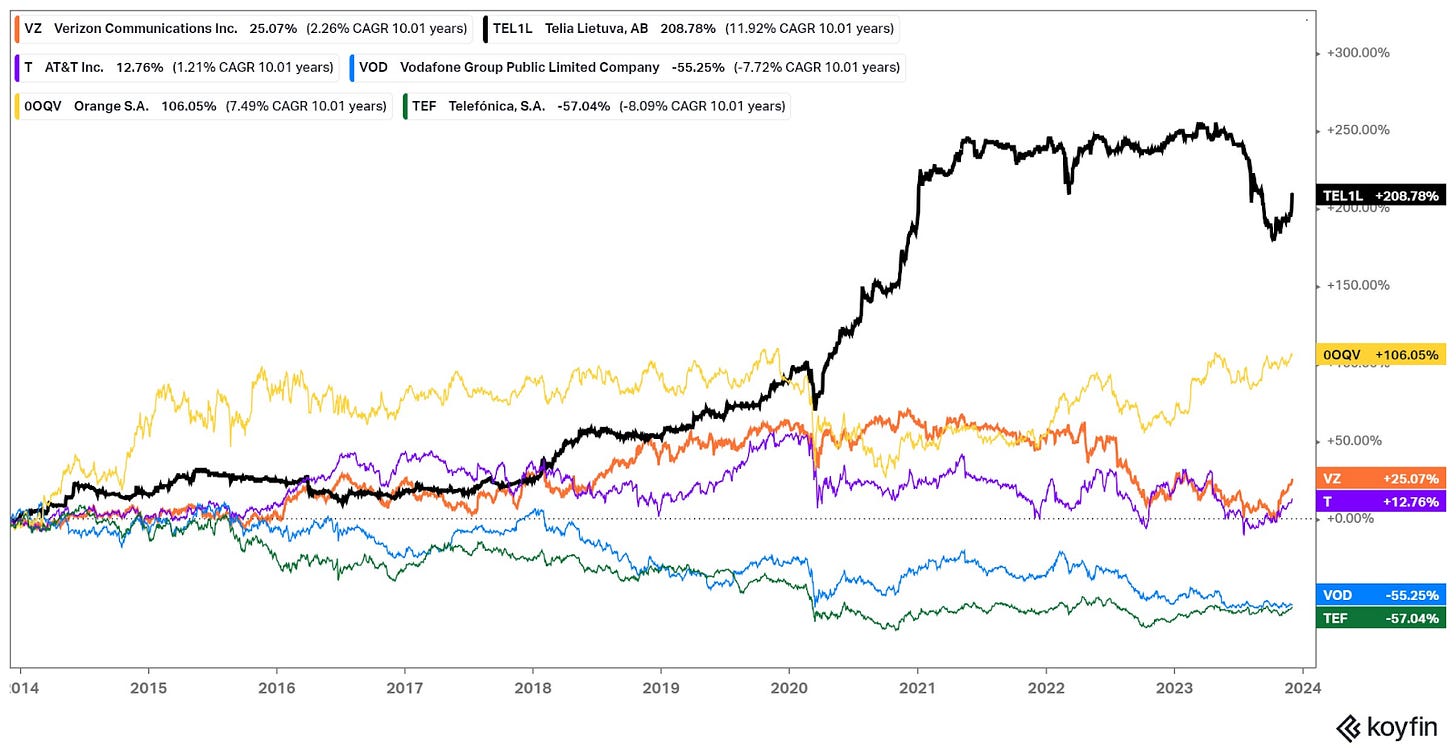

I don’t have a ton of perspective to add other than pointing out the company’s wild stock movement (black line below) in relation to most telecom businesses such as Verizon, AT&T, and Vodafone over the last decade - almost all of which have been equity value disasters:

Closing Thoughts

There seem to be plenty of compelling opportunities across the Lithuanian market. While I highlighted some above, there are many others to explore. It will be interesting to see if some of the private holding companies begin listing in the coming years as they reach a large financial scale and owners seek liquidity.

I suspect it is surprising to many that Lithuania’s market has been so performant over the last decade; it certainly was for me. The future is the more important discussion. Lithuania’s economy has mostly normalized from its Covid whipsaw, one of Europe's most extreme. Labor, material, and energy costs have now settled into a new normal. The government deficit flipped into the green in 2022 and will do the same in 2023 even with the ongoing military support for Ukraine. Government spending as a percent of GDP was historically ~35% and it has now normalized to these levels after the Covid spike.

Lithuania’s future is bright. Its people are beginning to move back to their country in masses after decades of net emigration of Lithuanian nationals. The economy is diversifying and innovating into higher growth industries leading to new job creation. The country continues to solidify its position on the geopolitical stage as a serious participant. Lithuania has its challenges (aging population, lack of credit access, corruption, etc.), but it is sure to work through these, in my opinion.

I welcome any corrections and updates, as I am sure I did not get everything correct.

Interestingly, these oil exports are all owned by just one company

If anyone has information about this lack of Tier 2 capital in the Baltics, please share.