Opus 3: Everything is a Signal

Along with Dystopian Legal Systems, World 2.0, Pandemic Rates, & Barber's Adagio

Today’s Musings

Admittedly, I had a tough time coming up with a long-form musing for this Opus - hence its late arrival into your inbox.

I ultimately decided on writing about something that I have long thought about at different points in my life and am still formulating a mental model around. That something being signals. In short, if you have the discretion to make a decision then the outcome of that decision is a signal: the car you drive, the clothes you wear, the food you eat, the pictures you post, the place you work, the phone you have, etc.

The fact that I am writing this newsletter is a signal of my own. Yes, I greatly enjoy writing because I understand the asymmetric power of writing in a public domain in the broader context of networking and self-gain. I have a genuine interest in the things I am sharing and want to share them with others so they can learn from them as well. But, there is a subconscious signal that I am reading many things and, therefore, I must be smarter as a result. While, in reality, I am still very stupid.

Being a bit meta here, but everyone also must have an opinion today on Covid-19 if they want to be taken seriously. The replacement of weather talk by the virus in our daily small-talk subject as the prelude to any Zoom call or an email greeting further proves this exact phenomenon. All of our relatively uninformed opinions provide us comfort in that we are keeping up with the news and the latest happenings.

Julien Lehr has the best thoughts around how signaling manifests itself in today’s consumer technology:

Digital products have one crucial disadvantage over atom-based products and services: Intangibility. Apps live on your phone or computer. No one can see them except for you. The signal message of a fitness app is the same as that of a gym membership or athletic wear (strength & fitness display), but the signal is much weaker because you can’t distribute it to anyone. I believe that this is the main reason why consumer software companies have a harder time monetizing than their physical counterparts.

The success of hardware + software plays (i.e. Peloton, Oura Ring, Tovala, etc.) is partly due to the inherent marketability of the products in your home. As Julien points out, irrationally expensive apps never took off like Gucci handbags or Louboutin heels because no one can see the apps on your phone. There is no signal to see. Consumer purchases are primarily driven by mimesis and the mimetic jealously is amplified by signaling. In short:

Man is the creature who does not know what to desire, and he turns to others in order to make up his mind. We desire what others desire because we imitate their desires. - René Girard

The Elephant in The Brain sums it up nicely:

“The takeaway from all these observations is that our species seems, somehow, to derive more benefit from speaking than from listening.”

I am nothing but guilty when it comes to all of the above. My lack of any restraint between my brain and vocal cords is a weakness at times when I just provide a stream of consciousness with no real value in it.

Signals are received well only when the receiver is in agreement. So is there really a benefit to the opposite side of this outcome? Are we even biologically capable of not signaling? We all like to think we make decisions purely based on our own desires, but society’s views mostly drive those wants. Purchase decisions purely driven by their utility are rare and unpopular social decisions are pressured by their second-order effects on relationships, careers, etc.

All of the above is the most fascinating part of consumer investing. Enterprise companies rarely win contracts because of their perceived popularity or brand. No purchasing department has ever had FOMO as a result of a different company’s decision to go with one provider or another. Consumer companies are a pure play on human psychology.

Homework Reading

I have no true technical skills and I am average at best in terms of people skills. I like to think the only thing I am above average at is understanding the incentives that drive rational peoples’ decisions. One of the well-known Munger-isms explains this importance well:

“Show me the incentive and I will show you the outcome.”

Simply put, legal systems are nothing but codified incentive systems with the goal of making sure rational people do the “right” thing. Scott Alexander has a few thought-provoking ideas in this write-up:

“Sloviria is an enlightened country. They do not blame criminals for their actions. They realize it is Society’s fault for making criminals that way. So when someone commits a crime, they punish Society.”

On the whole, humans act rationally and do not want to hurt one another. Combining the above with the idea of reflexivity, the treatment of drug addicts in today’s society (namely American society) drives the criminal behavior further to the extreme. Many people think the drug users themselves are the means to the end, while in reality, the drugs are the means. The societal view and treatment of these people is what makes them criminally inclined, not the drugs themselves.

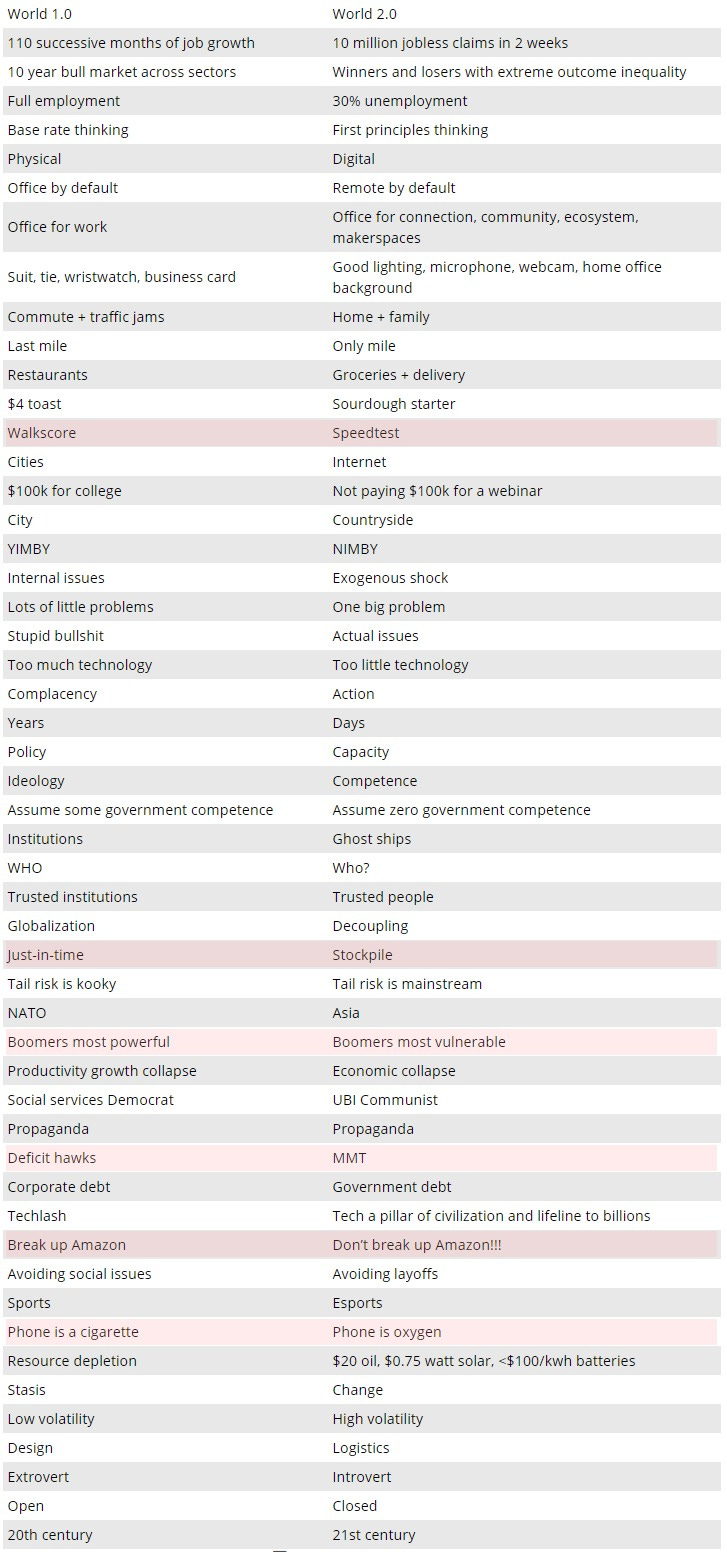

The Lenin-ism of “There are decades where nothing happens, and weeks where decades happen” is overused at this point, but the below table from Marginal Revolution was an interesting collection. An interesting post could be written on every one of these (and many journalists have already done just that) but it is powerful to see it listed together in a succinct way to understand the very basic changes that our society has and will make as a result of the virus.

I have highlighted some of my favorite comparisons.

“This week’s unemployment filings, compared to the last half-century, are considered by frequentist statistics as a 30-sigma event: less likely to happen than if you had to select one atomic particle at random out of every particle in the universe, and then randomly again select that same particle five times in a row. A 30 sigma event should be outrageously unlikely, at universe-scale. But they happen. And when they do, they warn us: the problem is not that the universe didn’t behave correctly. The problem is that we were wrong.”

The unemployment claims over the last two Fridays have been nothing short of mind-numbing. No macro excel model could even fathom numbers both this large and this fast. Danco’s continuation of his Incerto / Taleb series took at a look at these events in the broader Black Swan context. The above quote was something that got me thinking.

We only have ~2,750 good data points on unemployment filings over the last 60 years. That sample set is large (like your high school stats teacher hammered into you, a sample set of 30 is statistically sound / kosher) but it isn’t quite the sample size of 10^78 like the total particles in the universe. Maybe, events like the last two weeks are normally occurring over 2,500-3,000 claims and they should be built into the models. See the footnote below for how big that number is by the way…

The below research chart from UC Davis shows the average change in “real natural rates” (a.k.a. the risk-free rate adjusted for inflation) after pandemics over the last ~700 years.

Interestingly, Spain and Italy have always been the hardest hit economically and they both have been decimated this time around with Covid. As touched on in Opus 2, interest rates have uniformly fallen over the last 1,000 years and I expected them to follow that trend as the monetary controllers continue their dampening effort of volatility.

Coronavirus will accelerate this current paradigm of monetary juicing as risk appetites have all but disappeared from the world’s psyche.

“Measured by deviations in a benchmark economic statistic, the real natural rate of

interest, these responses indicate that pandemics are followed by sustained periods—over multiple decades—with depressed investment opportunities, possibly due to excess capital per unit of surviving labor, and/or heightened desires to save, possibly due to an increase in precautionary saving or a rebuilding of depleted wealth. Either way, if the trends play out similarly in the wake of COVID-19—adjusted to the scale of this pandemic—the global economic trajectory will be very different than was expected only a few weeks ago. If low real interest rates are sustained for decades they will provide welcome fiscal space for governments to mitigate the consequences of the pandemic.”

Flattening the Curve and Dimension of Time:

“The reason it feels like driving somewhere takes longer than driving home from that destination, even if both trips take the same amount of time, is that our “attention gate” is wider open on the way there because the directions are unfamiliar to us. We’re looking more carefully at road signs and landmarks to make sure we don’t get lost. On the way back, as we near home, we can flip to autopilot since we’ve done that trip so many times. Our attention gate narrows and our senses absorb less information. The memory of the return trip ends up as a smaller file in our memory banks. […] I’m constantly looking at the menu bar of my laptop to see what day it is. Who knew that flattening the curve also meant flattening the dimension of time.”

Today’s Music

I had recently come across Stjepan Hauser, a Croatian cellist that studied under the late Bernard Greenhouse. While his presentation can be a bit … over the top, there is nothing but pure emotion presented through his performances. One of my all-time favorite string-only pieces is Samuel Barber’s Adagio for Strings:

After a bit of research, I believe the cello being played is Bernard Greenhouse’s gift to Hauser upon his death in 2011: a Cornelissen cello. If you listen carefully (preferably with headphones) throughout the piece the cello gives off an almost breath-like sound - my favorite being the ending passage from 7:30-7:40. Some say the piece is a musical allegory of love / relationships / sex while many believe, since it was written amid WWII, it is an emotional outlay of Barber reflecting on the war.

I recommend watching this performance as well for the pure beauty of the venue: The Museum of Fine Arts, Budapest Hungary.

[1]: 10,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000